Polish tire recycling venture Contec S.A. secures funding worth EUR 15 million

Contec S.A. – a company that specializes in producing sustainable raw materials by upcycling end-of-life tires – has successfully secured a total of EUR 15 million in funding this year. The largest Polish manufacturer of steel roofing and facades – Pruszyński – has contributed an additional EUR 5 million to the funds already provided by VINCI and the Warsaw Equity Group. These two entities had initially invested EUR 10 million in Contec back in March 2023.

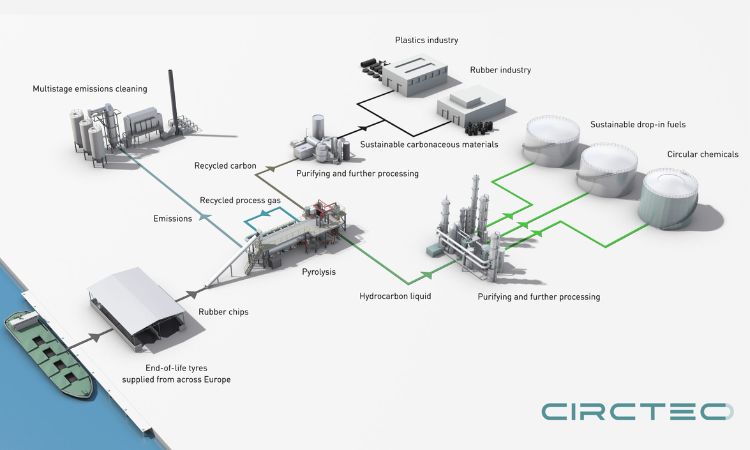

The investment will be used to triple the capacity of Contec’s current facility in Szczecin, Poland, and to position the company for the construction of several new commercial plants across Europe. This will support Contec's mission to accelerate the transformation of the manufacturing industry toward carbon neutrality.

Contec’s Szczecin plant | Photo by Contec.

Moving Towards a Circular Economy

Each year, over 1 billion end-of-life tires (ELTs) are discarded worldwide, often ending up in landfills or being incinerated. Improper disposal of ELTs leads to environmental issues such as land and air pollution. However, with the adoption of a circular economy, ELTs can now be given a second life.

ELTs are a prime example of a valuable resource that can be transformed into high-quality feedstock for reuse in a circular manner. Virtually all major tire producers have set targets to incorporate at least 30% of sustainable materials in the production of new tires by 2030.

“For many years, we have been supporting the efforts of the manufacturing sector to promote environmental sustainability and circularity. Contec's circular products significantly reduce the carbon footprint by more than five times compared to traditional fossil fuel-based raw materials. That’s why there is a great deal of interest in Recovered Carbon Black for the tire, manufactured rubber goods, plastics, and pigment industries.” – Krzysztof Wróblewski, CEO of Contec.

Three Large Investors Support Clean Tech

An investment of EUR 15 million has been secured from three prominent investors: VINCI, Blachy Pruszyński, and Warsaw Equity Group. The lead investor, VINCI, is a subsidiary of a leading Polish bank Bank Gospodarstwa Krajowego. Blachy Pruszyński is the largest Polish manufacturer of steel roofing and facades. The majority shareholder, Warsaw Equity Group, is a leading Polish private investment company that invests and supports projects with innovative solutions in the areas of B2B Automation & Efficiency, and Climate Tech. The EUR 15 million investment will be used to expand the capacity of Contec’s plant in Szczecin, Poland, almost threefold. Following the completion of the expansion project, the Contec plant will have a nominal capacity to process 33,000 tons of end-of-life tires per year. This will also bolster Contec's production capacity for its circular products, namely Recovered Carbon Black and Tire Pyrolysis Oil. This recent fundraising round marks a significant milestone in the company's growth. The demand for circular products has far surpassed the existing production capacity of the Szczecin plant. The raised capital will enable Contec to meet this growing demand by expanding production. The expansion of the Szczecin plant is already in progress, with additional production lines set to commence operations in the first half of 2024. Furthermore, Contec is actively scouting optimal locations for the construction of several new commercial plants across Europe. Moreover, the total funding of EUR 15 million will support Contec's Research & Development projects, focused on exploring new applications for the company’s products and advancing technology development.

Clean Tech Investments in Europe

At a total of EUR 15 million, this investment is one of the largest in the Clean Tech sector across Europe this year. The Net Zero Future50 report, produced jointly by PwC and Wolves Summit, highlights the promising trajectory of Clean Tech investment in Central and Eastern Europe (CEE), including Poland.

The CEE region has experienced a remarkable compound annual growth rate of around 57% between 2013 and 2020. During this period, more than 170 start-ups from the region secured a total of USD 1.7 billion in funding. Of this investment activity, Poland, Europe's sixth largest economy, ranked fifth in terms of investment volume. These statistics underline the growing importance and potential of Clean Tech investment in the region and demonstrate a positive trend towards sustainable and environmentally friendly initiatives.

The funding details are:

- VINCI (a subsidiary of Bank Gospodarstwa Krajowego), led the round with EUR 8 million.

- Blachy Pruszyński contributed EUR 5 million.

- Warsaw Equity Group, an existing investor and majority shareholder, participated with EUR 2 million.

About Contec S.A.

Contec S.A. specialises in the processing of end-of-life tires (chemical recycling), transforming them into circular rubber and plastic raw materials that deliver low-carbon-footprint products for the manufacturing industry - recovered Carbon Black, recovered Tire Pyrolysis Oil, and recovered Steel. Contec S.A. is the only company in the world that uses molten salt as a heat transfer medium. The Molten proprietary technology creates the conditions for a safer, more efficient, and economical method of production, designed with repeatable quality in mind. Since 2017, the company has contributed to decarbonising the manufacturing industry, focused on providing a sustainable replacement for virgin Carbon Black and petrochemical raw materials.

About Warsaw Equity Group

Warsaw Equity Group is a leading private investment firm that supports projects in the areas of innovative B2B solutions - automation and efficiency improvement, as well as sustainability. It has been active in the market for more than 20 years.

Weibold is an international consulting company specializing exclusively in end-of-life tire recycling and pyrolysis. Since 1999, we have helped companies grow and build profitable businesses.