IoT-based tire manufacturing and potential repercussions for tire recycling industry

Today, fast-paced technology advances in IoT and digitalization have been affecting almost all industries. One might think that tire recycling and pyrolysis industries are far beyond the scope of this trend. Yet, quite the opposite is happening. Below, we will explain how tire recycling and pyrolysis plant operators will be embracing effects of advancing tire manufacturing technologies.

Tire manufacturing favors IoT

In 2019, Bridgestone Corporation has announced that it developed a technology capable of estimating a wheel axle load and tire wear condition by using newly designed sensors inside tires that measure the change in strain that occurs when a tire makes contact with the road while in motion. Today, this technology is unique to Bridgestone and the first of its kind in the world, the company says.

The Smart Strain Sensor technology developed by Bridgestone is based on next-generation Internet of Things (IoT) technologies. In addition to keeping track of tire inflation pressure and temperature, the Smart Strain Sensor is able to measure the dynamic change in strain that occurs when a tire is in use. Then, an algorithm is applied to convert data gathered by the Smart Strain Sensor into tire load and wear information, which is then collected and sent to the cloud.

Previously released sensing technology of Bridgestone performs measurements based on accelerometer sensors, which require a certain amount of speed to acquire data. The new Smart Strain Sensor technology, however, measures strain, which is independent to speed. As such, the new technology is able to acquire highly reliable data even at low speeds.

Even though inclusion of IoT technologies in tire manufacturing tends to improve the quality of tires in the future, tire recycling and pyrolysis industry might consider this as a medium-term nuisance and will have to adapt.

Recycling is not consideration in new tire design

In December 2019, tire recycling and pyrolysis operators from North America and Europe met in Greenville, South Carolina (USA) to discuss current challenges and future trends of the industry. Among many important topics, there were several companies who are experiencing challenges posed by IoT and changes in tire manufacturing.

David Forrester, VP Liberty Tire Recycling – one of the largest tire recycling operators in the U.S. – highlighted that some innovations brought by tire manufacturers (e.g. pin studs or innovative materials) cause tire recycling equipment damages and, therefore, product recalls. IoT sensors, therefore, can also pose significant difficulties in operation of processors. The company urged tire manufacturing and tire recycling industries to unite to overcome challenges together.

Charles Astafan, General Manager at CM Shredders – a prominent manufacturer of high-end tire recycling equipment – expressed the same opinion about the challenges and supported Liberty’s appeal for the industry to rally together. Describing the new products of the tire manufacturers, Mr. Astafan mentioned challenges some of them pose for tire recycling equipment. IoT was not among them, however sensors can become plausible candidates for equipment damages or end product contamination.

Charles Astafan, General Manager at CM Shredders | Photos: courtesy of STREF.

According to Charles Astafan, the most challenging tires to recycle (from the point of view of equipment maintenance and longevity) are Michelin’s X Tweel Turf tires, Goodyear’s Wrangler All-Terrain Adventure tires with loads of Kevlar, Continental’s ContiProContact with Continual, Pirelli’s P-Zero, and Bridgestone’s Drivegard.

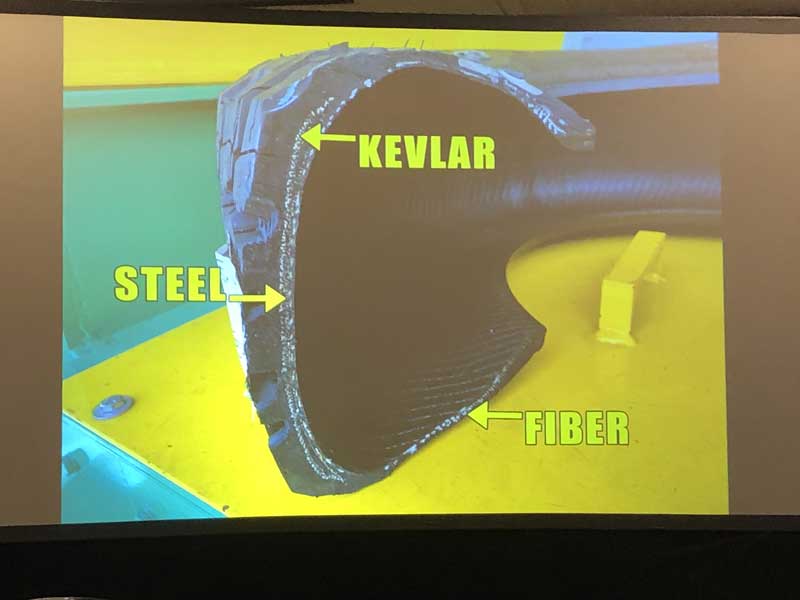

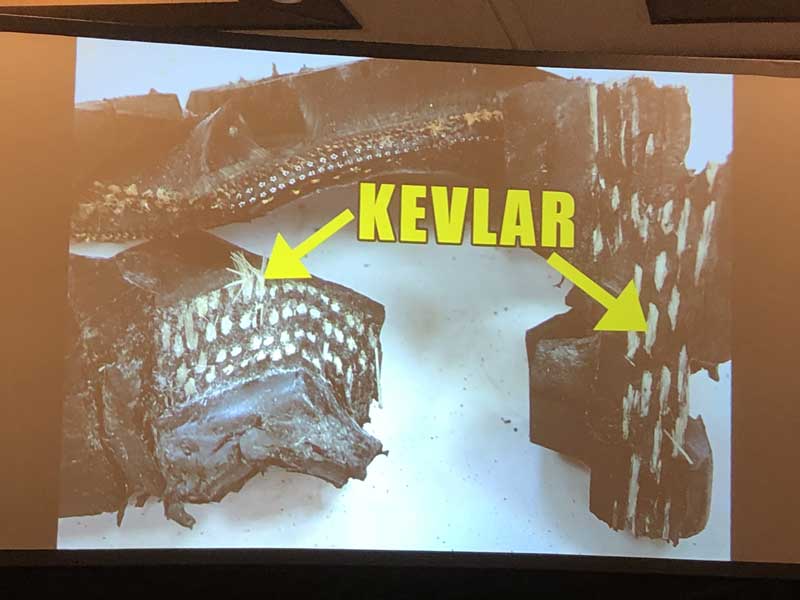

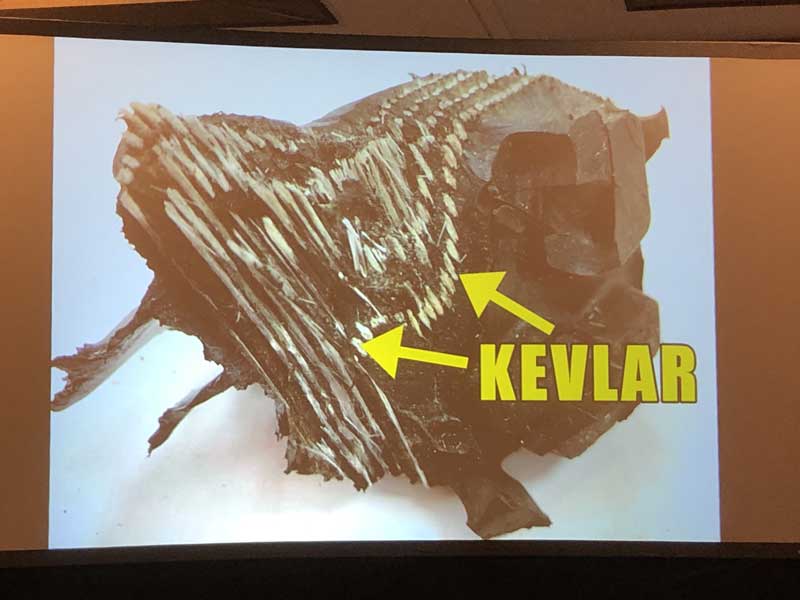

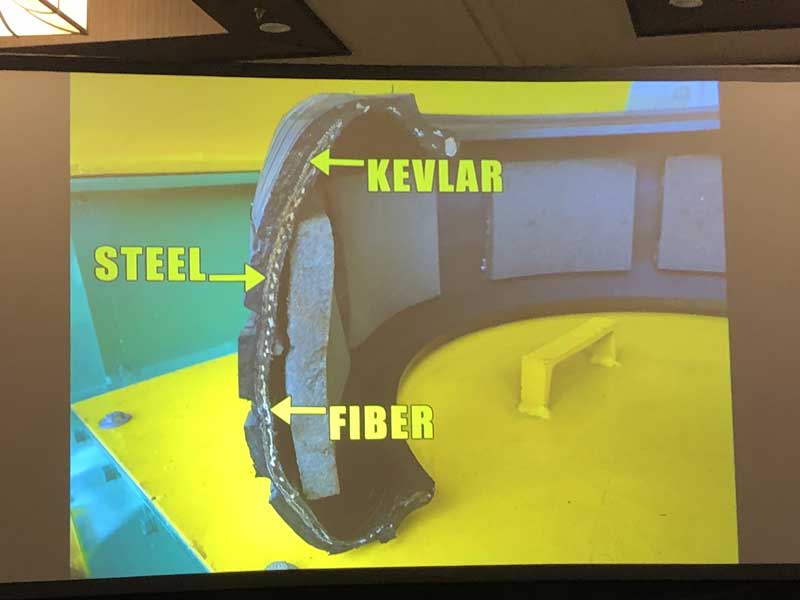

For example, the Goodyear Wrangler A/T tire is a tubeless radial, using Dupont™ Kevlar®, 30% more steel and Durawall™ technology using lots of fiber. The tightly woven Kevlar, steel, and fiber in the tire rubber pose new challenges.

Another example is the Michelin X Tweel Turf tire, which is an airless radial tire with shear beam technology and poly-resin spokes inside. Pirelli’s P-Zero is a tubeless radial which can run flat and has a noise cancelling system in the form of foam embedded on the inside of the tire wall.

Another challenge is posed by the Bridgestone Driveguard system which adds a silica seal in the tread interior and NanoPro-Tech re-inforced sidewalls.

Continental’s Contiseal™ is a gum-like substance applied on the inner wall, which makes it almost impossible to shred.

As tires using these new technologies enter the downstream recycling flows they will call for new processes for separation to be developed. At the very least these tires will have to be identified and separated from more conventional tires at the recycling gates.

Mr. Astafan decried the fact that as yet the recycling process difficulties are not as yet a consideration in the design and development of the new tires. He nonetheless concluded on a positive note, saying that the industry will adapt more rapidly than in the past, using new computer modelling and testing techniques. Yet he pinpointed that the industry’s stakeholders need to collaborate and rally together to make transition faster and enable circular economy work good.

Window of opportunity in circular economy

Indeed, sensors and innovative materials used in tires can affect purity of tire-derived rubber powder, tire pyrolysis oil, rCB and other products. However, if the technology becomes ubiquitous, the same sensors can enable tire collectors and recyclers to sort tires according to types of materials contained in tires, rim size, age, and other parameters. This, in turn, will allow operators producing a more homogeneous material and open up new markets for high-quality tire-derived materials in civil engineering and industrial applications.

To achieve this, hand-in-hand collaboration is needed between tire manufacturing companies and tire recycling industry. The industry abounds with opportunities for improvement and has great potential for building full-fledged circular economy.

Weibold is an international consulting company specializing exclusively in end-of-life tire recycling and pyrolysis. Since 1999, we have helped companies grow and build profitable businesses.