Weibold Academy: Recovered carbon black and its market potential

Despite recent technology advances and gradual development of circular economy concepts, markets for tire pyrolysis products still can be regarded as nascent. In this article we make an introduction in what carbon black is, elaborate on fields of application of virgin carbon black and venture to estimate the potential of recovered carbon black to replace its environment-harming counterpart – virgin material.

In the end of this article we make an estimation of a possible annual market size of recovered carbon black, modestly assuming virgin carbon black substitution rate at 20%. Hint: numbers suggest that recovered carbon black production is a profitable business rich in opportunities.

Carbon black: Introduction and definitions

Traditionally Carbon Black (CB) has been used as both a reinforcing agent and filler in automobile tires. Along with better understanding of CB’s unique properties as a material, it is presently used in a much wider range of applications across a large variety of products – car tires, conveyor belts, inks, plastic pipes, rubber mats, shoe soles and so forth. Virgin CB contains only trace amounts of impurities and carbon content is very close to 100%.

Virgin Carbon Black (vCB) is a material in form of fine black powder produced by the incomplete combustion of heavy petroleum products such as FCC tar, coal tar, or ethylene cracking tar. Carbon black is a form of paracrystalline carbon that has a high surface-area-to-volume ratio, albeit lower than that of activated carbon. The highest volume use of carbon black is as a reinforcing filler in rubber products, especially tires. While a pure gum vulcanization of styrene-butadiene has a tensile strength of no more than 2 MPa and negligible abrasion resistance, compounding it with 50% carbon black by weight improves its tensile strength and wear resistance.

Carbon Char (CC) or raw recovered Carbon Black (raw rCB) is one of the immediate products of the pyrolysis process. This material is of low value and has limited uses, such as energy generation in cement kilns. Carbon Char therefore needs to be refined according to the requirements of the markets and final applications to be used as a technical product in high value applications.

ASTM International – a standardization body introducing key definitions of products and materials with over 12,800 ASTM standards in work worldwide – recently published a first standard relating to recovered Carbon Black (rCB).

The ASTM Committee D36 on Recovered Carbon Black (rCB) was founded in 2017 to support the emerging rCB industry regarding the quality and safety of their products. Several sub-committees are responsible for developing standards for terminology, guidance, practices, and testing methods.

The new ASTM standard (D8178) meets the need for a set of common terms to clearly distinguish the value of rCB from Carbon Char (CC). Else, it facilitates the communication about the performance of rCB within proposed applications. D8178 outlines the importance of the differences between Char, Carbon Black (as defined by the ASTM Standard D3053), raw recovered Carbon Black and recovered Carbon Black (rCB).

Most importantly, the product name "recovered Carbon Black" (rCB) should apply only if the raw Carbon Black is freed from metals and fibers and was milled, which else gives typically semi-reinforcing properties to rCB in rubber.

There are several processes to refine and add value to raw rCB (CC) according to the final requirements of the product. This can be limited to size screening and separation of foreign materials (metals and fibers) or using chemicals or other processes to remove certain components inside the material. Refined carbon char derived from tire pyrolysis can be labeled as Recovered Carbon Black (rCB) and can be adapted with various processes for use in parts manufacturing and further refined for use by the chemical industry as pigment and fillers in ink and paints and other materials.

Post-processing CC into rCB is complex and requires capital-intensive technologies. Refining this material further will significatively improve the properties of carbon char, remove a very high proportion of foreign materials and convert it into a high value commodity that can replicate to a reasonable degree the properties of virgin black carbon. Depending on the application and performance requirements, rCB can replace between 10% and 100% of vCB in various manufacturing processes.

The holy grail application for recovered Carbon Black (rCB) is to be used by the tire manufacturing industry. The tire industry accounts for most of the worldwide carbon black consumption. However, the tire industry is slow to replace higher contents of vCB with rCB or accept large quantities in their production due to regulatory constraints, image, and supply concerns. But there is also a clear trend towards acceptance of rCB among tire manufacturers. Among others, Michelin has acquired a significant stake in a Swedish tire pyrolysis company and is planning rCB production plant in South America.

Overview of uses of carbon black

Virgin carbon black has been used for decades as a reinforcing agent in tires and has become a key material for the entire rubber industry. Thanks to its unique properties, carbon black is used in the majority of tire and non-tire rubber industries, and has expanded to include pigmentation, ultraviolet (UV) stabilization and conductive agents in a variety of everyday and specialty high performance products. The international carbon black association (ICBA) classified the uses of carbon black as follows:

- Tires and Industrial Rubber Products: Carbon black is added to rubber as both a filler and as a strengthening or reinforcing agent. For various types of tires, it is used in inner liners, carcasses, sidewalls, and treads utilizing different types based on specific performance requirements. Carbon black is also used in many molded and extruded industrial rubber products, such as belts, hoses, gaskets, diaphragms, vibration isolation, bushings, air springs, chassis bumpers, and multiple types of pads, boots, wiper blades, conveyor wheels, and grommets.

- Plastics: Carbon blacks are now widely used for conductive packaging, films, fibers, moldings, pipes and semi-conductive cable compounds in products such as refuse sacks, industrial bags, photographic containers, agriculture mulch film, stretch wrap, and thermoplastic molding applications for automotive, electrical/electronics, household appliances and blow-molded containers.

- Electrostatic Discharge (ESD) Compounds: Carbon blacks are carefully designed to transform electrical characteristics from insulating to conductive in products such as electronics packaging, safety applications, and automotive parts.

- High Performance Coatings: Carbon blacks provide pigmentation, conductivity, and UV protection for several coating applications including automotive (primer basecoats and clearcoats), marine, aerospace, decorative, wood, and industrial coatings.

- Toners and Printing Inks: Carbon blacks enhance formulations and deliver broad flexibility in meeting specific color requirements.

Although there are many uses of carbon black, different applications require different carbon black qualities and different properties.

Quality of carbon black depends on the process and the equipment. Therefore, while deciding on the equipment to buy, desired quality of carbon black and the demand of these applications should be taken into consideration.

Market potential and major rCB demand drivers

Considering that rCB is a partial and full replacement for vCB in various industries, the market potential for rCB is determined by the current markets of vCB. According to various industry experts and our estimations, during the last five years the worldwide consumption of vCB has continuously increased and it is estimated in a range of 11-13 Million tons per year. This represents an annual total market close to 16 Billion EUR.

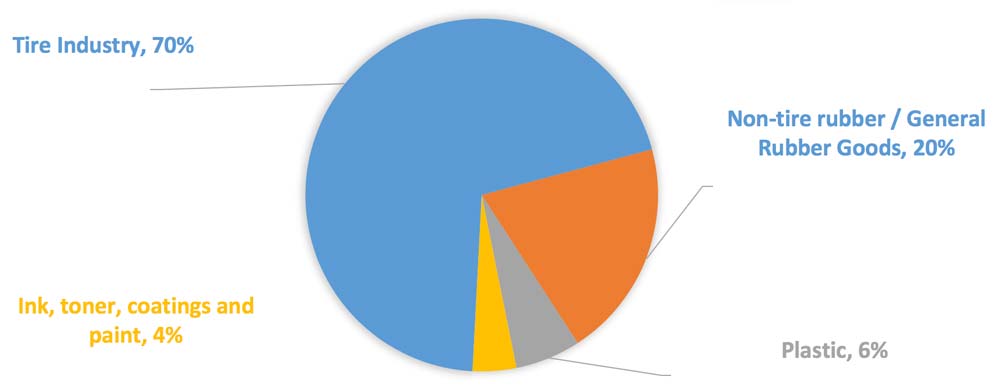

The most common use of vCB is in rubber and plastic applications (because of its properties as both filler and reinforcing agent). Due to its ability to reinforce rubber it is widely used in the tire manufacturing industry. In other rubber and plastic applications, it is used as filler. In this instance, filler is a diluting agent and is used primarily to lower volume costs. These applications account for over 95% of total world CB consumption. Around 4% of CB is used as ink pigments due to its excellent tint properties and the remaining fraction is used in other applications.

Chart: Carbon black end-use Markets

Chart and data by Weibold.

The tire industry is still the largest consumer of virgin carbon black, with an overall consumption in the range of 9 Million tons in recent years, it is represented by a small number of big players that dominate the market and have high leverage with suppliers. The industry accounts for approximately 70% of the worldwide consumption of carbon black, within this category the passenger tires accounts for 45% of the carbon black consumption, truck and bus tires 32%, and other tires 23% (OTR, motorcycle, aircraft, etc.).

Non-tire rubber products represent the second biggest segment in carbon black consumption, 20% overall, close 2-2.5 Million tons per year. This includes all rubber applications aside of tires and retreads and is largely diversified in several industries that manufacture products for rubber belts, wires, industrial rubber and other industries employing carbon black in their compounding activities.

Plastics and inks can be categorized as specialty markets and represent close to 10% of the vCB consumption – 1-1.2 Mio tons per year. This segment is also diversified in different end applications and the different grades and custom-made CB formulations required to achieve specific performances. The use of vCB in this segment is principally focused as a pigment or performance filler.

Whereas our research suggests that up to 100% of virgin carbon black can be replaced in some applications (e.g., plastic masterbatch, roofing products, inks, etc.), other applications have more modest numbers. For instance, 30%-50% of vCB could be replaced by rCB in passenger car tire sidewalls.

Assuming a substitution rate of 20%, we estimate that the annual volume of the global rCB market can account for some EUR 3.2 billion.

This makes pyrolysis business focused on rCB production a profitable venture. While success of the business depends on multiple factors such as production technology and quality of output, there is vast market opportunities available for pyrolysis operators.

We only see potential for the recovered carbon black on the global CB market, but we are also convinced that this growth is inevitable due to persistent political shift of developed economies towards sustainable and environment-friendly technologies. Today, newcomers to the market have a unique opportunity to shape the rCB industry and lead it in the next decades.

Concerted efforts needed to boost industry’s potential

Yet, to boost the use of recovered carbon black by the industry and speed up the rCB industry development, concerted efforts of all stakeholders are needed. The rCB industry very much relies on regulations and research. The latter is needed to enable pyrolysis operators to create a more homogeneous and stable output, while the former would foster inclusion of the industry into the loop of circular economy.

Regulatory constraints in big industries were principally caused by the lack of standardization of rCB. Good news is that ASTM is progressing in this matter and is creating specific standards for rCB. As the typical carbon black characterization methods based on structure level and surface area measurements may not correlate to in-rubber performance in an equal matter for recovered Carbon Black products, ASTM will drive the identification of specific test methods for rCB. However, rCB is a sustainable product in terms of a circular economy and provides different benefits under different applications.

Weibold’s services: Recovered carbon black market research

Weibold researches markets for pyrolysis products, produces tailor-made business plans, technology evaluation studies for pyrolysis and tire recycling equipment, as well as other services enabling recycling operators worldwide build or upgrade their business. Contact us at sales@weibold.com to learn more about our services and find out how we can help you put your business on sustainable footing!

Weibold is an international consulting company specializing exclusively in end-of-life tire recycling and pyrolysis. Since 1999, we have helped companies grow and build profitable businesses.