Weibold Academy: Interdependence of rCB and oil production due to economic and regulatory constraints

Month by month, our Weibold Academy series touches different topics from the world of tire recycling and highlights different sides of running this business.

This article sheds light on complexities and constraints of planning and operating a tire pyrolysis business and shows how Weibold can help companies realize economically sustainable tire pyrolysis plants.

Pyrolysis is an age old concept, whereas pyrolysis from end-of-life tires (ELTs) is a nascent field in an immature market. Today, in the ever present push towards a circular economy, this technology receives ever more attention in the tire recycling community – investments in tire pyrolysis businesses increase, technology keeps advancing and ever more operators appear on the market worldwide.

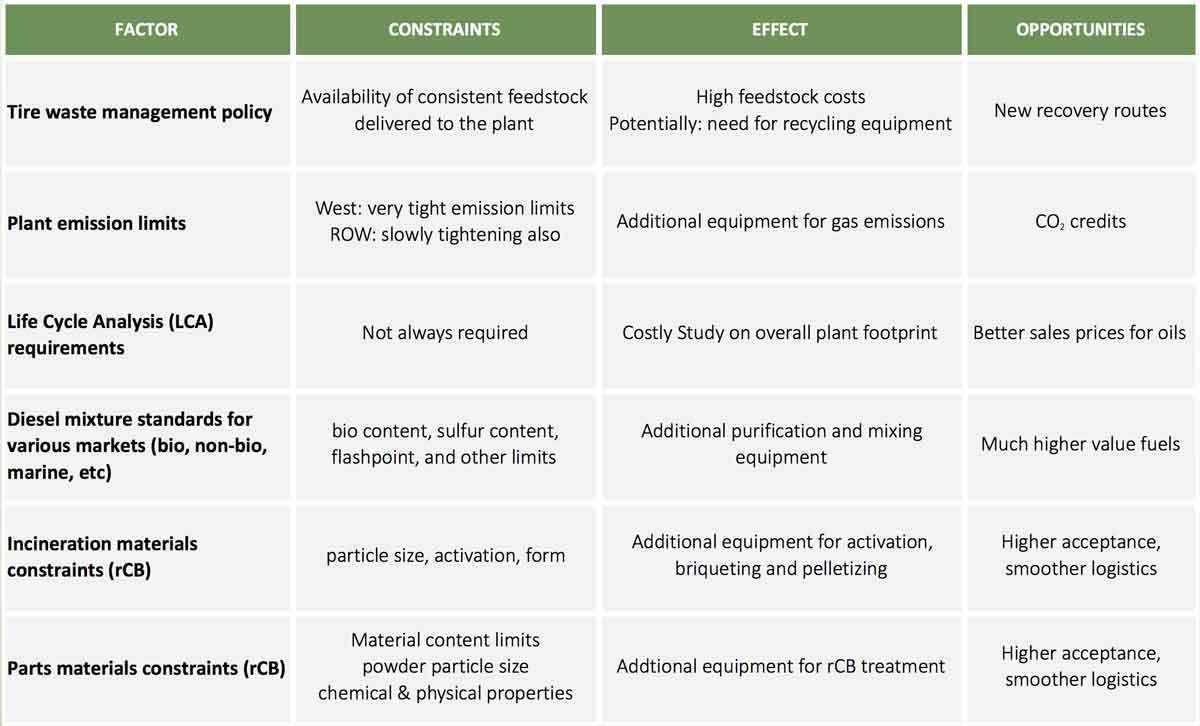

Despite these positive trends, we can observe that there are many claims but as yet only sporadic evidence of production successes. Conceptualizing and designing an economically viable pyrolysis plant still remains a complex task – this is a field with many choices and many variables where no single best solution exists. In addition, there are many pitfalls, such as misunderstood requirements, faulty technology, lack of industry standards or inadequate controls. There are also regulatory factors affecting the economics of ELT pyrolysis. Among them are: waste tire management policy, plant emission limits, life cycle analysis requirements, diesel mixture standards for various markets (bio, non-bio, marine, etc.), incineration materials constraints (rCB), parts materials constraints (rCB), etc.

These constraints represent significant challenges to planners and operators. But – as in any developing market – these challenges also represent promising opportunities. To see constraints, effects and opportunities arising from these factors, please consider the table below.

Table by Weibold.

One particular constraint for tire pyrolysis businesses involves regulatory requirements for low sulfur content in diesel and other fuels targeted by pyrolysis operators. This particular constraint holds many operations back from securing volume off-take contracts at reasonable margins. However just recently BASF announced off-take agreements with two European pyrolysis operators. This finally confirms that there are other industries besides oil refineries interested in tire derived oil. Furthermore we see more and more interest from virgin Carbon Black producers in such oil qualities as “sustainable” feedstock.

The size of the capital expenditures also comes into play – tire pyrolysis equipment prices range from EUR 50.000 to 30 million. And in order to build a successful operation, further investments may be needed. The need for controlling quality and consistency of waste tire feedstock, fuel oil requirements and CB buyer product specifications most often mandate additional pre- and post-pyrolysis treatment steps.

Weibold‘s financial tools allow us to precisely model and fine tune a given operation for a given location, feedstock supply situation and off-taker market by determining the operation’s sensitivity to a multitude of parameters, such as supply make-up, labor and power costs, throughput parameters, efficiencies, investment sizes, as well as output material specifications and achievable price ranges for TDFs and rCB.

Having researched and modeled greatly varying operations, we can demonstrate that, since oils invariably make up 35% to 40% of produced materials, pyrolysis plants usually only become viable when both the oil and rCB products are successfully marketed and monetized.

Based on these experiences we can also make the following general observations:

- Economies of scale are key: larger plants will return a higher return on investment (IRR).

- Until manufacturer markets (plastic goods, rubber goods, surface and paints, tires) accept recovered carbon black more widely:

- raw rCB sales will predominantly be sold to energy recovery uses

- large investment into raw rCB upgrading technology will be required

- pyrolysis operators have to invest strongly into in-house laboratory hardware

- margins are growing slowly but steadily

- there will be no room for errors in plant concept and execution

For new tire pyrolysis projects, we at Weibold have therefore devised a prudent approach to planning a new operation, which includes:

- Development of customers and products before making choices on technology.

- Establishment of a base-line business to secure a cashflow that sustains the operation (mostly based on sales of products for energy recovery use), upon which more sophisticated capabilities and product lines are developed that add profit to the bottom line

- Strong emphasis on control of quality, consistency and cost of the feedstock input (either through choice of supplier or through internal control by instituting a tire recycling line)

- Choice of technology supplier with a proven track record of economically viable reference project(s)

- Build-up of a technically savvy sales and support resource that can develop products in cooperation with the potential customers.

For existing tire pyrolysis operations we recommend carefully researching and finding potential customers within reach of the operation, developing a relationship with them, and analyzing their needs. Only once the product requirements are understood in the context of the off-taker’s products does it make sense to evaluate and select technology suppliers and invest in post-pyrolysis product refining equipment.

There also exist opportunities for operators of existing plants (specifically batch processing plants) to significantly improve plant throughput, performance and output quality without the need for post-processing refinement equipment. Weibold has been developing a special program together with reputable experts for converting batch reactors into continuous ones.

To mitigate the planning risks, meet the challenges and explore the opportunities in any phase of your tire pyrolysis project, contact Weibold and consider our specialized services. Our feasibility studies, market research modules, as well as technology evaluation and financial modeling services can help you avoid pitfalls, protect your investment, solve technical problems and improve your profit margins. Write us at sales@weibold.com to learn more about our work!

Weibold is an international consulting company specializing exclusively in end-of-life tire recycling and pyrolysis. Since 1999, we have helped companies grow and build profitable businesses.