ANRPC reports rising global natural rubber production despite market uncertainties

The Association of Natural Rubber Producing Countries (ANRPC) has published its Monthly NR Statistical Report for November 2024, highlighting key trends in natural rubber (NR) production, demand, and pricing.

Market trends and price movements

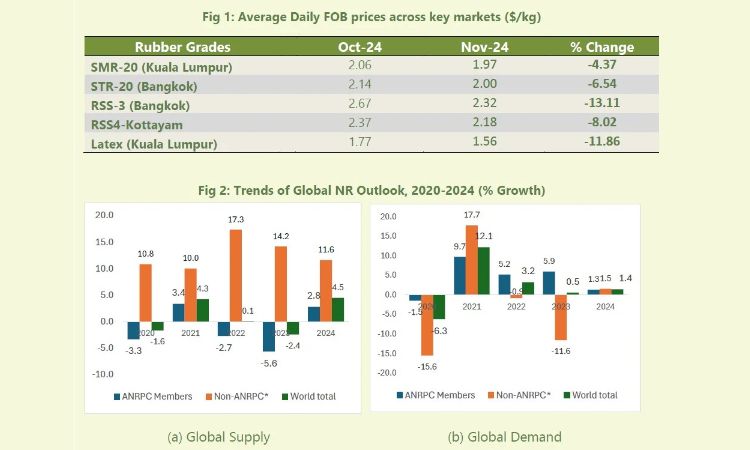

NR prices declined in November due to market uncertainties and resistance from major consumers to higher prices. Key factors influencing the market included the delayed implementation of the European Union Deforestation Regulation (EUDR), expected tariff increases on Chinese imports by the U.S., and fluctuating crude oil prices. These uncertainties prompted buyers to adopt a cautious “wait and see” approach, seeking lower-cost raw materials in anticipation of future demand growth. However, daily NR prices showed an upward trend toward the end of November, supported by China’s economic stimulus measures and an improved manufacturing outlook.

Average daily FOB prices across key markets (USD/kg) | Statistics and chart by ANRPC.

Production and demand overview

- Global NR production from January to November 2024 reached 12.7 million tons, reflecting a 2.4% increase year-over-year.

- Global NR demand reached 13.9 million tons, marking a 0.5% rise compared to the same period in 2023.

- A seasonal increase in supply during Q4 2024 is expected to contribute to lower NR prices.

Outlook for 2024 and 2025

The global NR production forecast remains steady, with an anticipated annual growth of 4.5%, bolstered by an updated outlook for China. Meanwhile, global demand growth for 2024 has been revised upward to 1.4%, reflecting improved expectations outside ANRPC member countries.

With economic recovery signals, including a second consecutive U.S. Federal Reserve rate cut in November and projected 4.4% growth in the ASEAN+3 region (China, Japan, Korea) in 2025, demand for NR is expected to remain resilient.

For further insights and detailed data, the full report is available from ANRPC.

Weibold is an international consulting company specializing exclusively in end-of-life tire recycling and pyrolysis. Since 1999, we have helped companies grow and build profitable businesses.